new mexico pension taxes

The bill would support retired veterans by making up to 30000 of their military retirement pay exempt from state income tax. New Mexico does have a state income tax.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each.

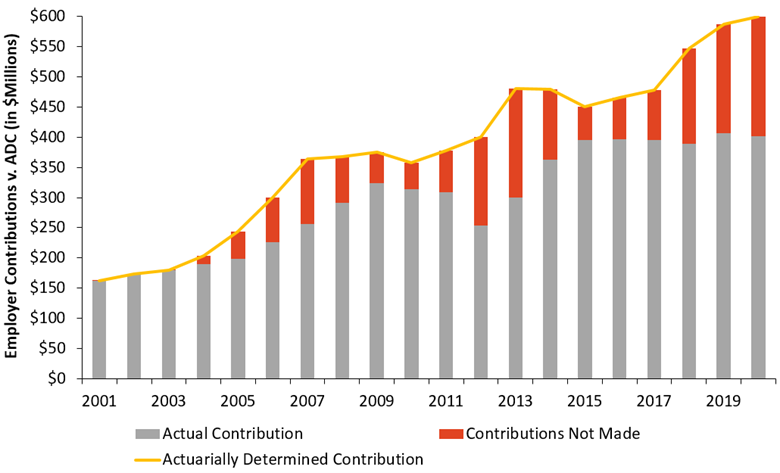

. Deductions both itemized and standard match the federal deductions. In the fiscal year 2020 total contributions of 14 billion were made to New Mexicos state and local pension systems. E-FIle Directly to New Mexico for only 1499.

Does New Mexico offer a tax break to retirees. House Bill 67 Tech Readiness Gross. House Bill 39 GRT Deduction for Nonathletic Special Events.

While the full 107 percent of salary contributed by individual teachers is for benefits the state contributes only 298 percent. Members of the public can view floor. Ad e-File Free Directly to the IRS.

Taxpayers 65 years of age or older. Governor enacts tax cuts for New Mexico seniors families and businesses. This law specifically stipulates that No State may impose an income tax on any.

Removes the 90 percent salary cap on pensionable compensation. Of this amount 6203 million came from employees. Does New Mexico offer a tax break to retirees.

Federal adjusted gross income cannot exceed 28500 for. The remaining 178 percent state contribution. Taxpayers age 65 or older can exclude up to 8000 of income.

The remaining 178 percent state contribution is to pay. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. When this reform is signed it will save middle and low-income seniors 84 million this tax year rising to 995 million by 2025.

It allows individuals aged 65 and over with a GDI of 51000 or less for. Will be subject to a 59 percent tax rate. Rules for filing taxes in New Mexico are very similar to the federal tax rules.

10 1996 Congress enacted the Pension Source Tax Act of 1996 PL. Is my retirement income taxable to New Mexico. Approximately 86 of New Mexico seniors will qualify for the.

Any veteran who rated 100 service-connected disabled. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. Like the federal tax system the Land of Enchantment uses brackets.

Active duty military pay is tax-free. Railroad Retirement benefits are fully exempt but New Mexico taxes Social Security benefits pensions and retirement accounts. New Mexico Tax Breaks for Other Retirement Income.

52 rows 40000 single 60000 joint pension exclusion depending on. Disabled Veteran Tax Exemption. Michelle Lujan Grisham a Democrat signed.

Free 2020 Federal Tax Return. New Mexico does have a sales tax as well. Rules for filing taxes in New Mexico are very similar to the federal tax rules.

E-File Directly to the IRS State. For tax year 2021 that means. New Mexico Veteran Financial Benefits Income Tax.

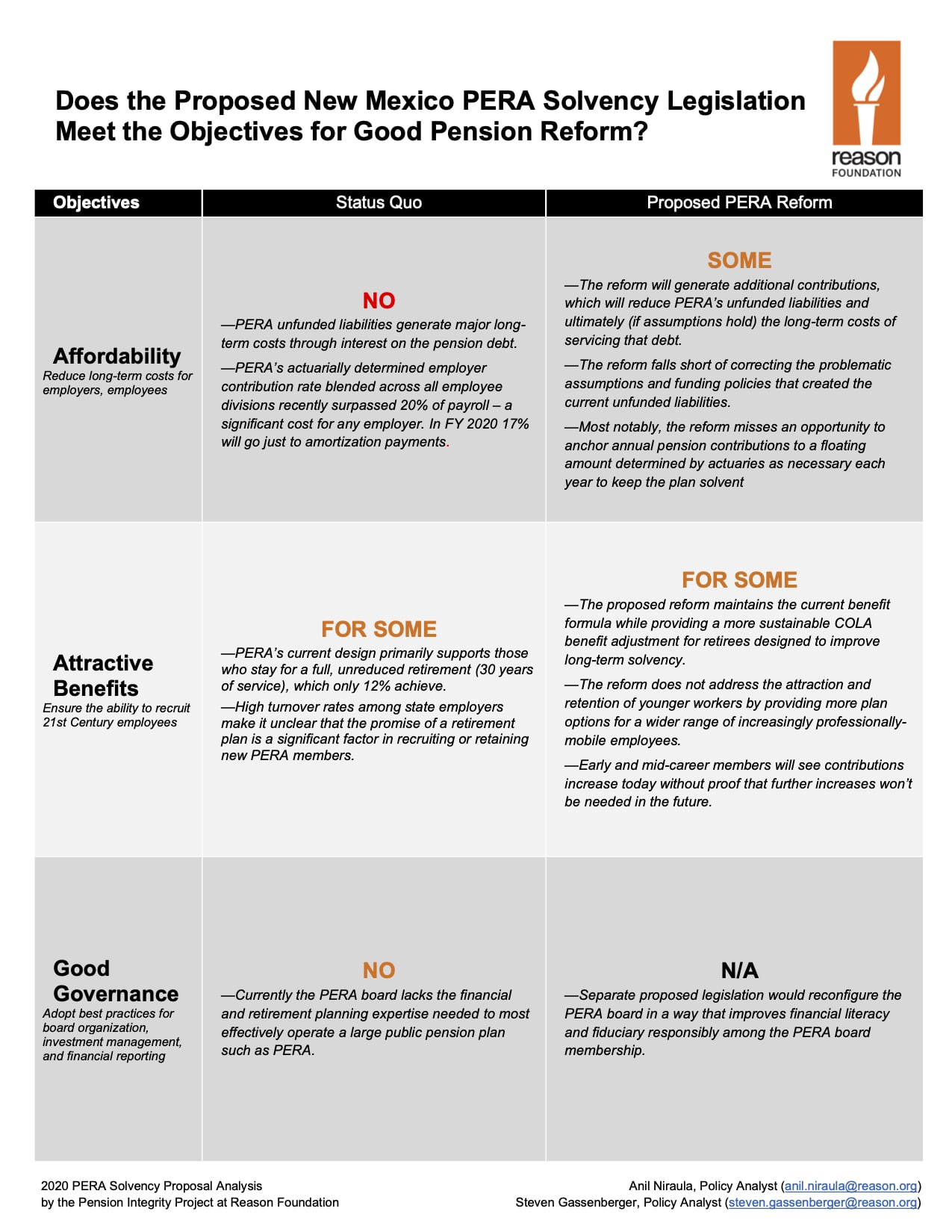

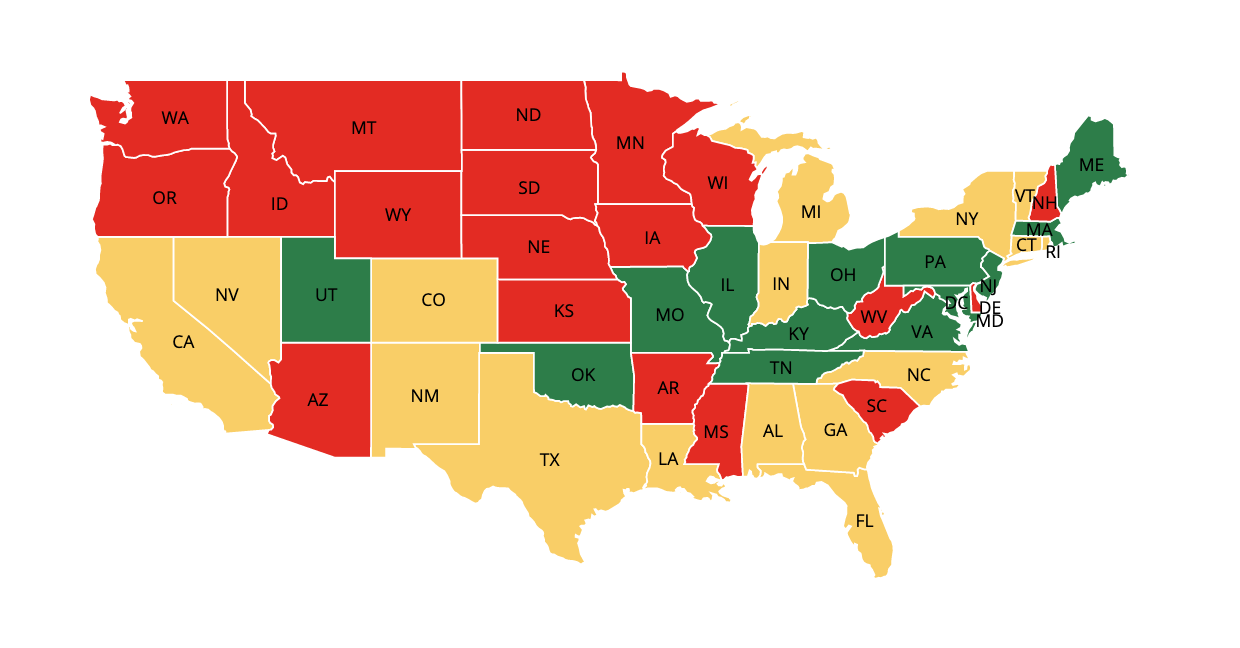

New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted. The changed COLA is expected to vary between 05 and 3 each year and average out to 164 annually. New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits.

Tax Withholding For Pensions And Social Security Sensible Money

As Debt Grows New Mexico Pension Plan Considers Retirement Benefit Reductions For Teachers Reason Foundation

Retirement Security Think New Mexico

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Expat Tax Returns New Mexico State Residency I Greenback Team

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

Proposed Pera Reform An Important Step Toward Pension Solvency In New Mexico Reason Foundation

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Retirement Security Think New Mexico

Retirement Security Think New Mexico

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

New Mexico Retirement Tax Friendliness Smartasset

Public Employees Retirement Association Of New Mexico Pera

New Mexico Estate Tax Everything You Need To Know Smartasset

New Mexico Retirement Tax Friendliness Smartasset

Retiring These States Won T Tax Your Distributions

States That Don T Tax Retirement Income Personal Capital

Tax Withholding For Pensions And Social Security Sensible Money