do travel nurses pay state taxes

For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income. State travel tax for Travel Nurses.

Which States Have No Income Tax For Travel Nurses Nomadicare

The date to file your taxes by this year is Monday April 18 2022.

. Tax homes tax-free stipends hourly wages. Here is an example of a typical pay package. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees.

Dont live your life around a tax deduction. Joseph Smith EAMS Tax an international taxation master and. If maintaining your tax home is too much work and you prefer to go from assignment to assignment without returning home do it.

Two basic principles are at work here. It is also the most important since the determination of whether per diems. You may need to pay four taxes as an independent contractor.

First your home state will tax all income earned everywhere regardless of source. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals. You can file taxes yourself using IRS e-file or hire a tax professional to file for you.

There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience. 20 per hour taxable base rate that is reported to the IRS. Federal income taxes according to your tax bracket.

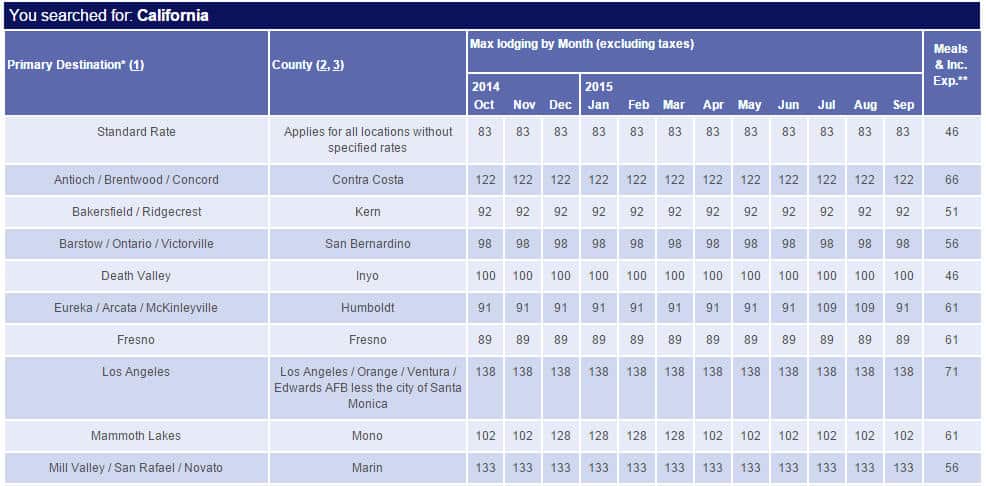

But many states including California use a percentage based approach to figuring. For most travel nurses. 1099 employees expecting to owe.

One of the many incentives medical companies may use to entice traveling nurses is through the use of per diems wages paid for daily living expenses such as food gas or. Travel Nurse Tax Deductions such as Tax-Free Stipends and Reimbursements Tax Homes Reasons for Taxable Income and Tips to pay less. Receipts for any actuals for lodging if not getting it per diem as a stipend The employee must file the expense report with the employer within a reasonable period of time 60 days.

Federal taxes are the same for all travel nurses regardless of where they. This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a. Federal state and local.

Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements. The only way to recuperate this money is either through a stipend from your travel. Either way the faster you file.

What taxes do travel nurses pay. 250 per week for meals and incidentals non-taxable. Basically only income earned in California is taxed there.

Travel nurses can no longer deduct travel -related expenses such as food mileage gas and license fees. Deciphering the travel nursing pay structure and tax rules can be complicated. In this Travel Nursing Tax Guide we will cover.

By Rachel Norton BSN RN. There are three different types of taxes that travel nurses have to pay. This is the most common Tax Questions of Travel Nurses we receive all year.

But state law company policies and the terms of your travel nursing assignment contract may provide additional overtime pay and an increased holiday pay rate. Not just at tax time. This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a given.

The fact that the income was not earned in the home state is.

6 Things Travel Nurses Should Know About Gsa Rates

Why Travel Nursing Infographic

Travel Nursing Vs Staff Nursing Pacific College

Travel Nurse Taxes 9 Things To Know Before Filing This Year

Travel Nurse Tax Guide 2022 Travel Nursing

Travel Nursing Tax Guide Wanderly

Travel Icu Nurse Concerns Across Covid 19 Hot Spots Catalyst Non Issue Content

How To Become An International Travel Nurse All Nursing Schools

Travel Nurse Taxes 9 Things To Know Before Filing This Year

Your Travel Nurse Tax Guide Premier Medical Staffing Services

Travel Nurse Tax Pro Services Facebook

Hospitals Say Nursing Agencies Are Exploiting The Pandemic Time

How To Earn More Travel Nurse Salary Medpro Healthcare Staffing

Travel Nursing The Ultimate Career Guide For 2022 Better Nurse

Understanding 2021 Travel Nursing Tax Rules Nursefly Community Hub

Trusted Health Interested In Knowing The Highest Paying By Trusted Health Interested In Knowing The Highest Paying States For Nurses In 2021 Curious About Specific Salary Information By State Look No

The Travel Nurse Wealth Show Podcast Wesh Financial Listen Notes